Virginia Property Tax Calculator

Calculate Your Virginia Property Tax

Based on assessed value and your county's payment schedule

Your Estimated Taxes

First Installment

Second Installment

County Payment Details

When you own property in Virginia, one of the first questions you’ll ask is: Are property taxes paid in advance or arrears? The answer isn’t simple, and it varies by county. But knowing this upfront saves you from surprise bills, late fees, or even tax liens. In Virginia, property taxes are generally paid in arrears - meaning you pay for the time you’ve already lived in or owned the property. But there’s a twist: most counties split the payment into two installments, and the due dates are set by local law, not state law.

How Virginia Property Taxes Work

Virginia is a home rule state, which means each county and city sets its own tax rules. That includes when taxes are due, how they’re calculated, and whether they’re paid in advance or arrears. The state doesn’t dictate a single system - it leaves it to local governments to decide. So while the general rule is arrears, you can’t assume it’s the same in Fairfax County as it is in Roanoke.

Property taxes in Virginia are based on the assessed value of your land and buildings. That assessment happens every year or every few years, depending on the locality. The tax rate is then applied to that value. For example, if your home is assessed at $400,000 and your county’s tax rate is $1.20 per $100 of value, your annual tax bill is $4,800. That amount is usually split into two payments.

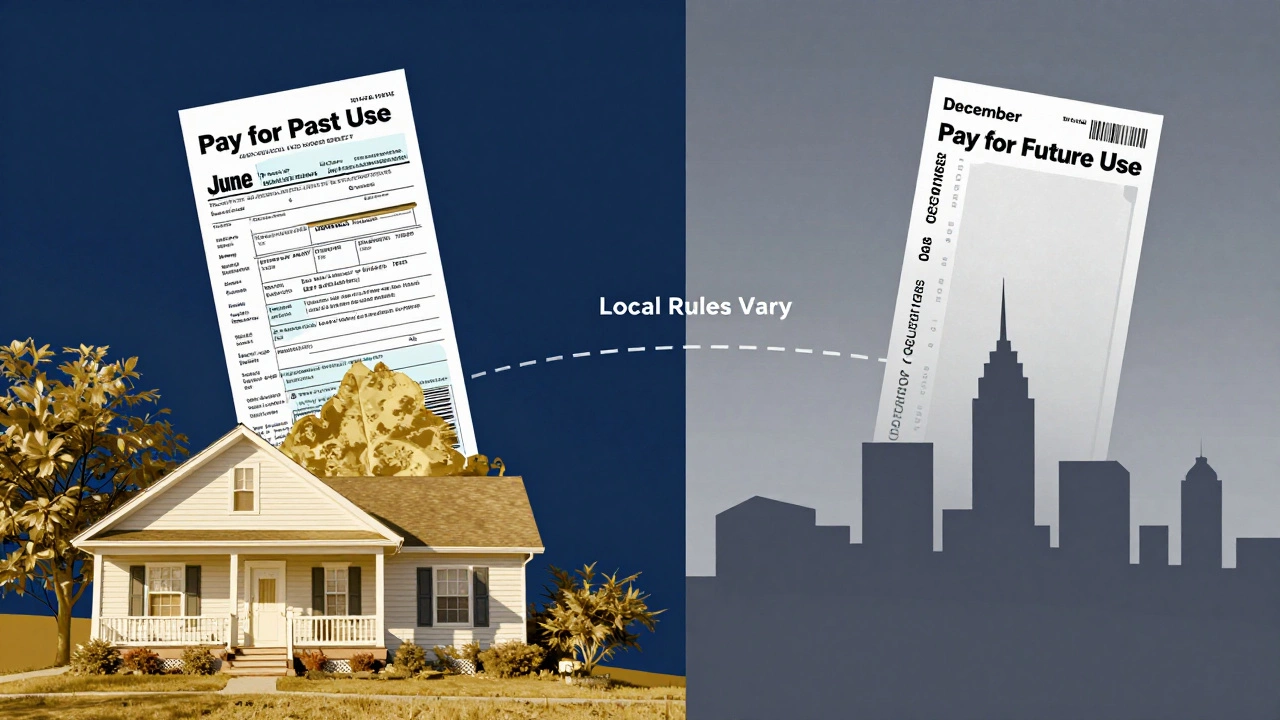

Most Counties Pay in Arrears - But Not All

In the majority of Virginia counties, including Loudoun, Henrico, and Prince William, property taxes are paid in arrears. That means the bill you receive in June covers the previous six months - January through June. The second bill, due in December, covers July through December. So when you pay your June bill, you’re paying for time you’ve already used.

This system makes sense for the county. It gives them time to finalize assessments and mail out bills after the fiscal year has partially passed. It also gives homeowners a buffer - you don’t pay for the full year upfront. But it can catch new homeowners off guard. If you bought a house in March, you’ll still get a tax bill in June for the first half of the year. That’s because the seller didn’t pay it, and the tax liability transfers to you as the new owner at closing.

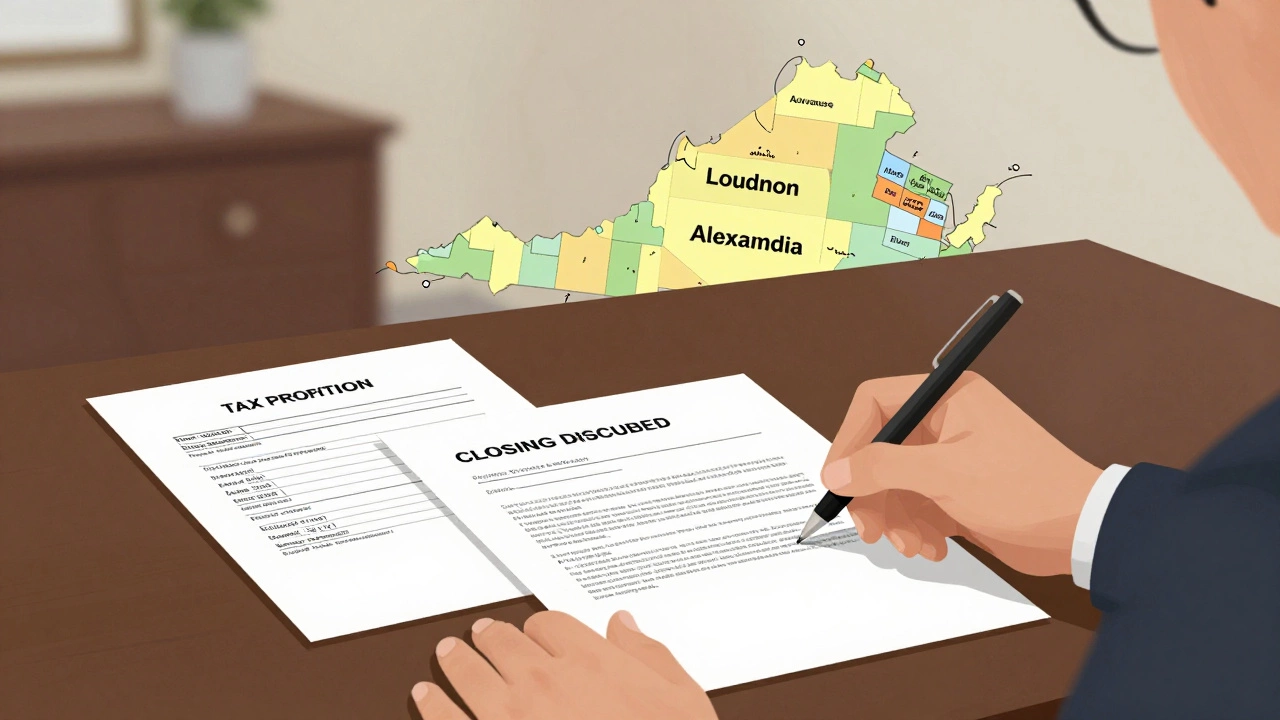

There are exceptions. Some cities like Alexandria and Norfolk have moved toward paying in advance. In Alexandria, the first installment is due in June and covers July through December. The second is due in December and covers January through June. That’s the opposite of arrears - you’re paying before you use the property. Always check with your local commissioner of the revenue or treasurer’s office to confirm your county’s system.

What Happens at Closing?

If you’re buying a home in Virginia, your closing attorney or title company will handle tax prorations. They’ll look at the last paid tax bill and figure out how much the seller owes for the time they lived there, and how much you owe for the time you’ll own it after closing. That amount is then adjusted in your closing statement.

For example, if you close on May 15 and taxes are paid in arrears, you’ll owe the seller for the days from January 1 to May 15. The seller gets credit for the portion they’ve already paid. You’ll pay the full June bill when it comes, but you’ve already reimbursed them for the time they owned the home. This is standard practice - but it’s easy to miss if you’re not paying attention to your closing disclosure.

When Are the Due Dates?

Most Virginia counties have two due dates: June 5 and December 5. But not all. In Fairfax County, the first installment is due June 5 and the second is due December 5. In Arlington, it’s June 15 and December 15. In Roanoke, it’s June 30 and December 31. Some rural counties have different dates. Late payments usually incur a 10% penalty, and interest accrues monthly.

Don’t assume your due dates are the same as your neighbor’s. Even within the same county, cities and towns may have different schedules. The best way to find your exact dates? Go to your county’s official website and search for “property tax due dates.” Or call the treasurer’s office. They’ll give you the exact dates, penalty rules, and payment options.

How to Pay and Avoid Penalties

Most counties accept online payments through their treasurer’s portal. You can pay with credit card, debit card, or e-check. Some still accept checks by mail or in person. A few offer payment plans for those who can’t pay the full amount at once - but you must apply before the due date. If you miss a payment, the county can place a lien on your property. That lien can be sold to investors, and you’ll end up paying more in fees and interest.

Set up calendar reminders for both due dates. Even if you’re on autopay, verify the amount. Assessments can change. If your home was recently renovated or the neighborhood saw a spike in values, your bill might jump unexpectedly. Check your assessment notice - it usually arrives in March. If you think it’s too high, you can appeal it before the due date.

What About New Construction or Renovations?

If you build a new house or add a room, your property’s assessed value will go up. That means your tax bill will increase. But the increase doesn’t happen immediately. Most counties assess property as of January 1 each year. So if you finish your addition in October, you won’t see the higher tax bill until next June. But you’ll owe the difference for the full year once the assessment is updated.

Some counties offer partial-year billing for new construction. Others don’t. Again, check with your local office. If you’re planning a big renovation, factor in the potential tax increase - it can be thousands of dollars.

What If I Can’t Pay?

If you’re struggling to pay, don’t ignore the bill. Virginia offers hardship programs in some counties for seniors, disabled homeowners, or low-income residents. You might qualify for a deferral or reduced payment plan. But you must apply before the due date. After that, you’re subject to penalties and collection action.

There’s also a state program called the Real Property Tax Relief Program for the Elderly or Disabled. It doesn’t eliminate taxes, but it can reduce your bill by up to 50% if you meet income and age requirements. You need to apply through your county, not the state.

Final Tip: Know Your County’s Rules

Virginia doesn’t have one rule for property taxes. It has 95 counties and 38 independent cities - each with its own system. What’s true in Richmond may be false in Lynchburg. What’s standard in Chesapeake may be outdated in Roanoke. The only way to avoid mistakes is to know your local rules.

Start by visiting your county’s official website. Look for the Commissioner of the Revenue or Treasurer’s Office. Download their property tax guide. Save the phone number. Bookmark the payment portal. Keep a copy of your last tax bill. If you’re buying a home, ask your agent or attorney to confirm the tax payment schedule. Don’t assume.

Property taxes in Virginia aren’t just a number on a bill. They’re tied to when you own the property, when you pay, and how your local government runs its finances. Get it right, and you avoid stress, penalties, and legal headaches. Get it wrong, and you could lose your home to a tax sale - which happens in Virginia every year.

Are Virginia property taxes paid in advance or arrears?

Most Virginia counties collect property taxes in arrears - meaning you pay for the period you’ve already owned the property. The June bill covers January through June, and the December bill covers July through December. However, some cities like Alexandria and Norfolk have switched to paying in advance. Always check with your local treasurer’s office for exact rules.

When are Virginia property taxes due?

Due dates vary by locality. Most counties have two installments due on June 5 and December 5. But some, like Arlington, use June 15 and December 15. Others, like Roanoke, set deadlines for June 30 and December 31. Late payments usually trigger a 10% penalty and monthly interest. Always confirm your exact due dates with your county’s treasurer.

Do I pay property taxes at closing when I buy a home?

Yes, but not directly. At closing, your attorney or title company will prorate the property taxes based on the ownership period. If you close in May, you’ll reimburse the seller for the portion of taxes they’ve already paid for January through May. You’ll pay the full June bill when it arrives, but you’ve already covered the seller’s share. This is standard practice and appears on your closing disclosure.

What happens if I don’t pay my property taxes in Virginia?

If you miss a payment, you’ll face a 10% penalty and monthly interest. After 90 days, the county can place a tax lien on your property. That lien can be sold to investors, and if you don’t pay within a year, your home could be sold at a tax sale. Virginia allows tax sales to recover unpaid taxes, and many properties are lost this way every year.

Can I get help paying property taxes if I’m on a fixed income?

Yes. Virginia offers the Real Property Tax Relief Program for the Elderly or Disabled, which can reduce your tax bill by up to 50% if you meet income and age requirements. Many counties also have local hardship programs for low-income homeowners. You must apply before the tax due date - you can’t wait until you’re in arrears.