Rent Affordability Calculator

The National Low Income Housing Coalition recommends spending no more than 30% of your income on rent. Let's see if your income can afford rental housing in Virginia.

Virginia's median rent in 2025: $1,750 for a one-bedroom apartment

Virginia median household income: $87,000 (varies significantly by region)

To afford $1,500 rent, you'd need $60,000 annual income (30% of income)

Important Information

Virginia has a housing affordability crisis with limited affordable units. If you're struggling:

- Check Section 8 Housing Choice Voucher waitlists

- Consider living outside major metro areas where rents are 20-30% lower

- Look into tenant unions for better protection against rent hikes

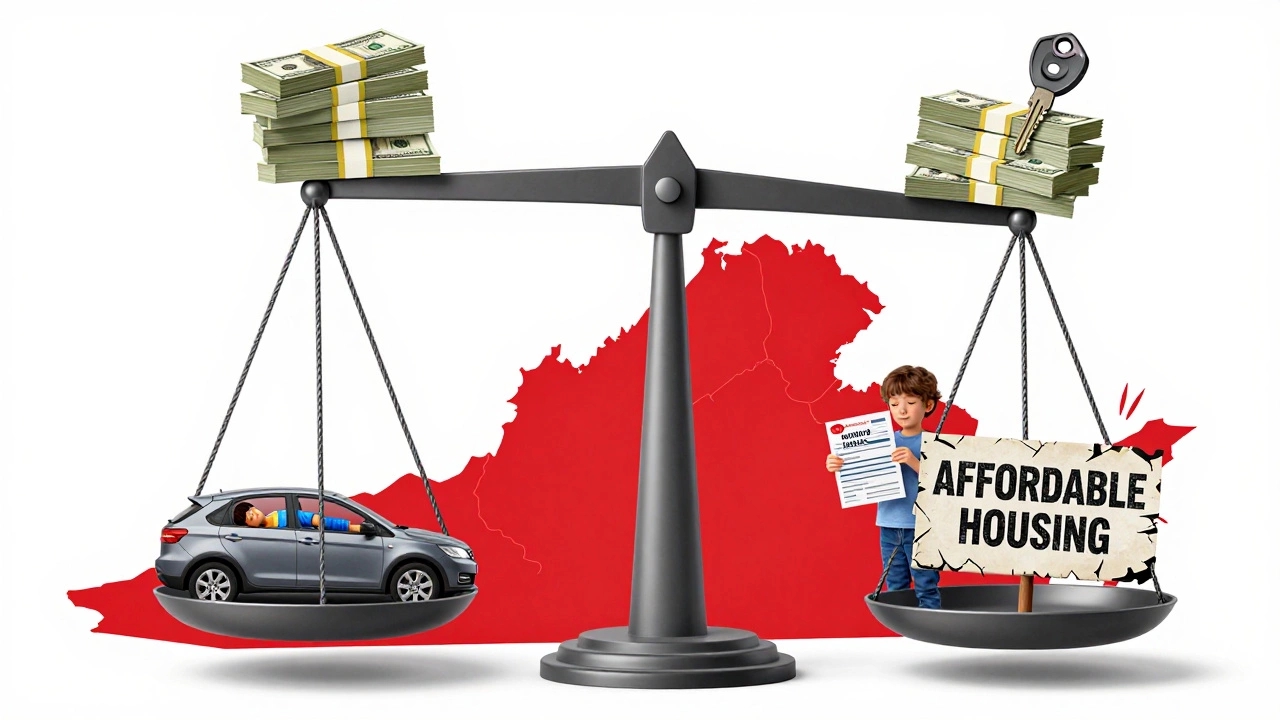

Virginia’s rent prices have jumped faster than most people’s paychecks. In Richmond, a one-bedroom apartment that cost $1,200 in 2020 now runs $1,800. In Northern Virginia, near Washington D.C., it’s not unusual to see $2,500 for a two-bedroom that’s 15 years old and has no in-unit laundry. People are moving farther out, doubling up with roommates, or even sleeping in cars. But why? It’s not just inflation. It’s a mix of demand, limits on supply, and policies that made things worse instead of better.

People are moving to Virginia - but not enough homes are being built

Virginia has become one of the most popular states for people relocating from New York, New Jersey, and even California. The state offers lower taxes than those places, good schools, and proximity to D.C. But here’s the catch: while over 100,000 people moved to Virginia each year between 2020 and 2024, builders only added about 45,000 new housing units annually. That’s a gap of 55,000 homes per year. That’s not a shortage. That’s a canyon.

Local governments in places like Fairfax, Arlington, and Alexandria have strict zoning rules. They limit apartment buildings to low densities. Many neighborhoods only allow single-family homes. Even when developers want to build townhouses or fourplexes, they get stuck in permitting delays that last 18 to 24 months. In contrast, states like Texas and Florida approved thousands of new units in the same time frame. Virginia didn’t just fall behind - it froze.

Corporate relocation is pushing prices up

Companies like Amazon, Meta, and Google have moved major offices to Northern Virginia. Amazon’s HQ2 in Crystal City brought over 25,000 high-paying jobs. These workers don’t need cheap housing - they need modern apartments with gyms, co-working spaces, and pet-friendly policies. Landlords noticed. They stopped renting to students or low-income families and started targeting corporate tenants. Renters who used to pay $1,400 for a one-bedroom now find themselves priced out because the landlord raised rates to $2,200 to match what a tech employee is willing to pay.

It’s not just big tech. Defense contractors, cybersecurity firms, and federal contractors have also flooded the region. These jobs pay well, but they’re concentrated in a small geographic area. That creates a bidding war for apartments. When 50 people apply for one unit, the landlord picks the one with the highest credit score and biggest paycheck. Everyone else gets left behind.

Property taxes are making landlords raise rents

Virginia’s property taxes have climbed steadily over the last five years. In Fairfax County, the average tax bill on a $500,000 home jumped from $5,800 in 2020 to $7,600 in 2025. Landlords don’t absorb these costs - they pass them on. A landlord who owns a $400,000 apartment building might have seen their annual tax bill go up by $2,400. To cover that, they raise rent by $200 a month. That’s $2,400 extra per year per unit. Multiply that by 10 units? That’s $24,000. That’s why you see rent hikes of 10% or more even when no repairs were done.

Some landlords are even selling their properties because they can’t keep up. But the buyers aren’t individuals - they’re investment firms. These firms buy up entire apartment complexes, renovate them slightly, and turn them into luxury rentals. The goal isn’t to house people - it’s to maximize returns. That’s why you’ll see a 1970s apartment complex with new paint, new flooring, and a $2,300 monthly rent. It’s not about quality. It’s about profit.

There’s almost no affordable housing being built

Virginia’s affordable housing programs are underfunded and slow. The state’s Low-Income Housing Tax Credit program only funds about 1,200 units per year. That’s less than 2% of the housing needed. Cities like Norfolk and Roanoke have waiting lists for subsidized housing that are 3 to 5 years long. Meanwhile, new construction is almost entirely focused on high-end units. In 2024, 82% of new apartments built in Virginia were priced above $2,000 per month. Only 5% were targeted at households earning less than 60% of the area median income.

Even when developers try to build affordable units, they get blocked by local rules. In Charlottesville, a developer proposed a 48-unit affordable complex. The city approved it - then added a requirement for 10 parking spaces per unit. That doubled the cost. The project died. That’s not an accident. It’s policy.

Short-term rentals are eating up long-term stock

In places like Virginia Beach and Alexandria, Airbnb and VRBO have taken thousands of units off the long-term rental market. A landlord can make $300 a night on a two-bedroom during summer - that’s $9,000 a month. Compare that to $2,200 for a year-long lease. Why would anyone rent long-term? The answer: they don’t. Between 2020 and 2025, over 12,000 rental units in Virginia were converted to short-term rentals. That’s 12,000 homes that used to house families, students, or retirees - now used for weekend tourists.

Some cities tried to cap short-term rentals. Virginia Beach limited owners to 90 nights per year. But enforcement is weak. Many hosts just rotate between different properties or use fake addresses. The result? Fewer homes for people who need them. More pressure on the remaining rentals. Higher prices.

Wages haven’t kept up

Virginia’s minimum wage is $12.50 an hour. That’s higher than the federal rate, but it’s still not enough. A full-time worker at minimum wage makes $26,000 a year. To afford a $1,500/month apartment, you need to earn at least $60,000 - according to the National Low Income Housing Coalition’s rule of thumb (30% of income on rent). That’s more than double the minimum wage. Even at $18/hour - a decent retail or warehouse job - you’re still only making $37,440. You’d need to spend 48% of your income on rent to live in a $1,500 apartment. That’s not sustainable. That’s why so many people are doubling up or moving out of state.

Meanwhile, median rent in Virginia hit $1,750 in 2025. Median household income? $87,000. That sounds good - until you realize that number is pulled up by tech workers in Northern Virginia. In rural areas like Southwest Virginia, median income is under $50,000. Rent there? Still $1,300. That’s 31% of income - the federal threshold for being rent-burdened. In cities, it’s 40%, 50%, even 60%.

What’s being done - and what’s not

Some cities have tried rent control. Arlington considered it in 2023. But state law in Virginia bans rent control in most areas. So local leaders are stuck. They can’t cap rent increases. They can’t force landlords to build affordable units. The only tools they have are zoning changes and tax incentives - and those take years to work.

Meanwhile, the state legislature keeps passing bills that help developers - like speeding up permits for luxury projects - but ignores bills that help renters. In 2024, a bill to create a statewide housing trust fund failed by one vote. That fund could have given $200 million to build affordable housing. It didn’t pass.

What’s clear is this: Virginia’s rent crisis isn’t caused by one thing. It’s caused by decades of underbuilding, corporate demand, tax hikes, short-term rentals, and political inaction. Fixing it won’t be easy. But ignoring it will make things worse.

What renters can do right now

- Look outside major metro areas. Places like Fredericksburg, Lynchburg, or Harrisonburg still have rents 20-30% lower than D.C. suburbs.

- Consider a roommate. Splitting a three-bedroom can cut rent in half - and sometimes utilities too.

- Apply early. Many landlords now require applications 60 days before move-in. Don’t wait until the last week.

- Check for housing vouchers. The Section 8 waitlist is long, but it’s the only real help for low-income renters.

- Join a tenant union. Groups in Richmond and Norfolk are pushing for better lease terms and protection from sudden rent hikes.

There’s no quick fix. But understanding why rent is so high is the first step to fighting back.

Is rent control legal in Virginia?

No. Virginia state law prohibits cities and counties from enacting rent control ordinances. This ban has been in place since 1984 and was reinforced in 2020. Even if a city like Richmond or Alexandria wanted to cap rent increases, they legally can’t.

Why are rents higher in Northern Virginia than in other parts of the state?

Northern Virginia has the highest concentration of high-paying jobs - especially in tech, defense, and federal contracting. That drives demand. At the same time, strict zoning laws limit new construction. The result: intense competition for a limited number of units. Rents there are 40-60% higher than in southern or western Virginia.

Are there any government programs to help with rent in Virginia?

Yes, but they’re limited. The Section 8 Housing Choice Voucher Program offers subsidies, but the waitlist is often 3-5 years long. Some counties offer emergency rental assistance for people facing eviction, but funding runs out quickly. There’s no statewide program that guarantees help for all eligible renters.

How long are rental leases in Virginia?

Most leases are for 12 months. Landlords can raise rent after the lease ends - with 30 days’ notice for month-to-month tenants, or no notice if the lease expires. There’s no state law limiting how much rent can increase between leases, as long as it’s not discriminatory or retaliatory.

Can a landlord evict someone without cause in Virginia?

Yes. Virginia is a “no-cause” eviction state. If your lease is up or you’re on a month-to-month agreement, a landlord can ask you to leave without giving a reason - as long as they give 30 days’ written notice. There’s no protection against eviction just because you’re a long-term tenant.