NOI Calculator

Property Income

Results

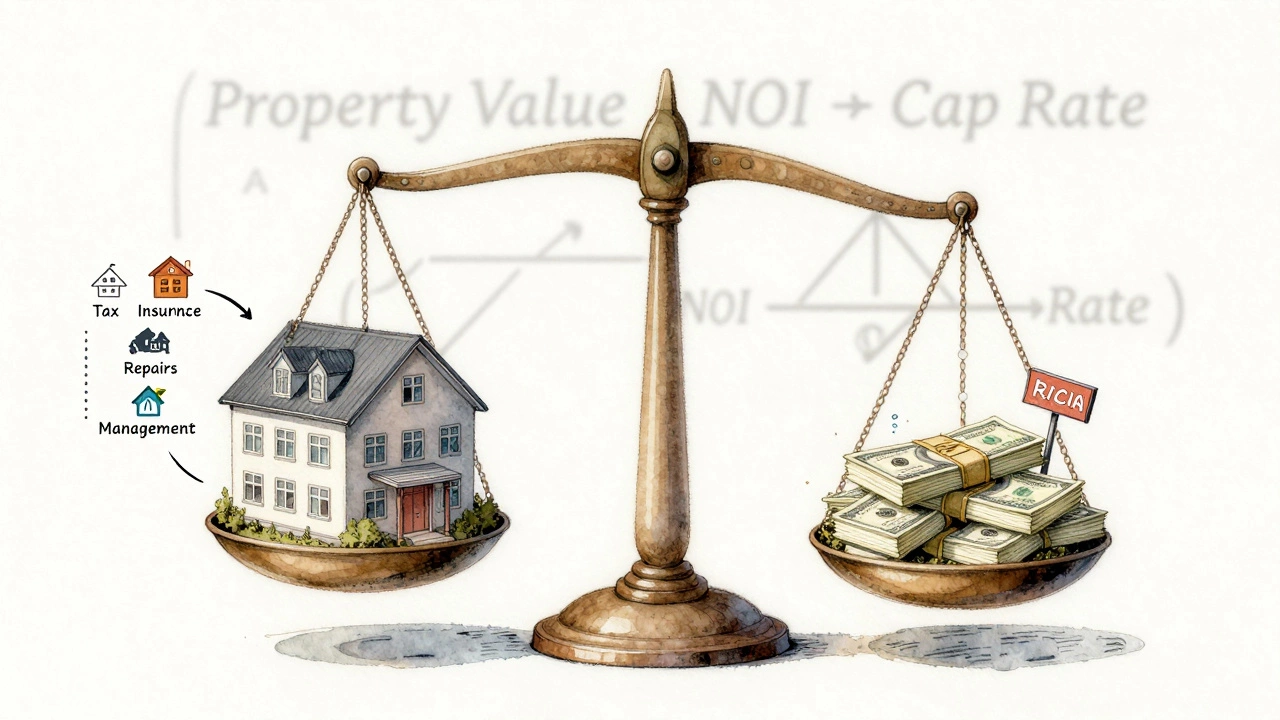

NOI = Gross Income − Vacancy Loss − Operating Expenses

When you're looking at a commercial property for sale, you’ll hear one term over and over: NOI. It’s not just jargon. It’s the single most important number that tells you if a building is worth buying-or walking away from.

What exactly is NOI?

NOI stands for Net Operating Income. It’s the total money a property makes after you pay all the normal, everyday costs of running it-but before you pay taxes, interest on loans, or depreciation.

Think of it like your take-home pay after rent, groceries, and utilities-but before you pay your student loan or save for vacation. For a commercial building, that means:

- Money coming in: rent from tenants, parking fees, laundry income, vending machine revenue

- Money going out: property taxes, insurance, maintenance, repairs, trash removal, property management fees, utilities if you pay them

Subtract the expenses from the income. What’s left? That’s NOI.

Example: A small office building brings in $120,000 a year in rent. You spend $40,000 on taxes, insurance, repairs, and management. Your NOI is $80,000. That’s the real profit the building generates.

Why does NOI matter more than rent?

A landlord might tell you, “This building rents for $150,000 a year.” Sounds great, right? But what if the roof leaks every winter? What if the property manager takes 10%? What if property taxes jumped 30% last year?

NOI cuts through the noise. It doesn’t care what the listing says. It only cares about what actually lands in your bank account after bills are paid.

Buyers use NOI to compare properties apples-to-apples. Two buildings might both rent for $200,000. But one has low taxes and great tenants. The other has high maintenance and frequent vacancies. The one with the higher NOI is the better deal-even if the rent looks the same.

How to calculate NOI step by step

Here’s how you do it yourself:

- Start with gross rental income. Add up all rent collected in a year.

- Add other income: parking, storage, signage, pet fees, etc.

- Subtract vacancy loss. If you expect 5% of units to sit empty, take 5% off your total income.

- Subtract operating expenses: taxes, insurance, repairs, maintenance, management, utilities (if paid by owner), landscaping, accounting.

Don’t include mortgage payments, income taxes, or capital improvements (like a new HVAC system). Those don’t count as operating expenses.

Formula: NOI = Gross Income − Vacancy Loss − Operating Expenses

Real example: A retail strip center has $250,000 in annual rent. Tenants pay $15,000 in common area maintenance fees (you keep this). You estimate 3% vacancy. Expenses: $70,000 in taxes, $18,000 insurance, $25,000 maintenance, $30,000 management.

Calculation:

- Gross income: $250,000 + $15,000 = $265,000

- Vacancy loss: 3% of $265,000 = $7,950

- Operating expenses: $70,000 + $18,000 + $25,000 + $30,000 = $143,000

- NOI: $265,000 − $7,950 − $143,000 = $114,050

That $114,050 is what you’d use to value the property.

How NOI drives property value

Commercial properties aren’t priced like houses. You don’t look at square footage or how many bedrooms. You look at the income it generates.

Investors use a metric called the capitalization rate (or cap rate) to turn NOI into a price. The cap rate is the expected return on investment.

Formula: Property Value = NOI ÷ Cap Rate

Example: If a building has an NOI of $100,000 and the market cap rate is 7%, the estimated value is $1,428,571.

If the cap rate jumps to 8%, the value drops to $1,250,000-even if the NOI hasn’t changed. That’s why NOI is the anchor. Everything else floats around it.

What can mess up NOI?

NOI looks clean on paper. But in real life, things go wrong:

- Hidden expenses: A seller might not mention that the boiler needs replacing next year. That’s a $50,000 hit-not in their operating budget.

- Lease expirations: If 3 tenants leave in 6 months, your income drops. Check lease terms before buying.

- Overstated income: Some sellers count rent that hasn’t been paid or include one-time fees.

- Understated expenses: “We don’t pay for trash-tenants do.” But what if the lease says you pay for it? Always read the leases.

Always get a full financial statement from the seller, and hire a commercial real estate accountant to review it. Don’t trust the numbers on the listing sheet.

NOI vs. cash flow: what’s the difference?

NOI isn’t your cash in hand. That’s cash flow.

NOI = profit before debt. Cash flow = profit after debt.

Example: You buy a building with a $1 million mortgage. Your monthly payment is $6,000. Your NOI is $120,000 a year ($10,000/month). Your cash flow is $10,000 − $6,000 = $4,000/month.

NOI tells you how good the asset is. Cash flow tells you how much money you pocket each month. Both matter-but NOI is the foundation.

What’s a good NOI for commercial property?

There’s no universal number. It depends on location, property type, and market conditions.

But here’s a rough guide:

- Office buildings: 50-70% of gross income

- Retail centers: 60-75%

- Apartment complexes: 55-65%

- Industrial warehouses: 65-80%

Higher NOI percentages usually mean lower expenses or better management. Lower percentages? Watch out-something’s eating into profits.

How to boost NOI

Don’t just buy a property. Improve it.

- Raise rents: If you’re below market, adjust. Most leases allow annual increases.

- Reduce vacancies: Offer incentives for long-term leases. Improve curb appeal.

- Lower expenses: Switch to LED lighting. Negotiate better insurance rates. Use a local property manager instead of a big firm.

- Add income streams: Install EV chargers. Sell advertising space. Add storage units.

A $50,000 upgrade that adds $15,000/year in income? That’s a 30% return on investment-better than most stocks.

What to do if NOI looks low

If a property’s NOI is weak, don’t walk away. Ask:

- Is the rent below market?

- Are expenses bloated?

- Are there unused spaces you can lease?

- Is the building under-managed?

Many buyers buy low-NOI properties on purpose. They plan to fix them. That’s called “value-add investing.”

But be careful. Fixing a property takes time, money, and patience. Make sure you have the resources-or a partner who does.

NOI is your compass

Commercial real estate is full of shiny numbers and flashy promises. NOI is the only number that doesn’t lie.

It tells you the truth about what the building can earn. It helps you avoid overpaying. It lets you compare deals fairly. It shows you where you can make money after you buy.

If you’re serious about buying commercial property, learn NOI like you learn your own name. Memorize the formula. Ask for it on every listing. Verify it with third-party records. If a seller won’t give you the NOI breakdown, walk away.

Because in commercial real estate, the best deals aren’t the ones with the nicest lobby. They’re the ones with the highest, cleanest NOI.

Is NOI the same as profit?

NOI is not the same as profit. NOI is the income from a property after operating expenses but before taxes, interest, and depreciation. Your actual profit (or cash flow) is what’s left after you pay your mortgage and taxes. NOI shows how well the property performs on its own-without debt.

Does NOI include property taxes?

Yes, property taxes are always included in NOI. They’re a regular, predictable operating expense. If you don’t include them, your NOI will be artificially high and misleading.

Can NOI be negative?

Yes, NOI can be negative. This happens when operating expenses exceed income. A negative NOI means the property is losing money on its own-even before you pay your loan. Most lenders won’t finance a property with negative NOI unless you plan to fix it quickly.

How often should NOI be recalculated?

Recalculate NOI at least once a year, after the fiscal year ends. Also recalculate after major changes: new leases, rent increases, major repairs, or new expenses. Investors track NOI monthly for active properties to spot trends early.

What’s the difference between NOI and EBITDA?

NOI is specific to real estate. EBITDA (Earnings Before Interest, Taxes, Depreciation, and Amortization) is used for businesses. They’re similar, but EBITDA includes things like corporate overhead, salaries of non-property staff, and marketing. NOI only includes expenses directly tied to running the building.