Housing Affordability Calculator

Can You Afford Housing?

Enter your annual income to see how it compares to housing costs in high-cost states

By 2026, housing in the United States has become a lottery ticket for most working families. You can work full-time, even two jobs, and still not afford a two-bedroom apartment in half the country. The question isn’t whether housing is expensive-it’s where it’s so broken that even middle-class incomes vanish before rent is due. The answer isn’t a surprise, but the numbers behind it are worse than you think.

California Still Leads, But It’s Not Close

California remains the most unaffordable state to live in. Not because it’s the biggest, or the most populated, but because wages haven’t kept up with housing costs for over 20 years. The median home price in California hit $910,000 in late 2025, according to the California Association of Realtors. That’s more than triple the national median of $298,000. Rent isn’t any better. A one-bedroom apartment in Los Angeles averages $3,100 a month. In San Francisco, it’s $3,800. In San Diego, it’s $3,300. These aren’t outliers-they’re the baseline.

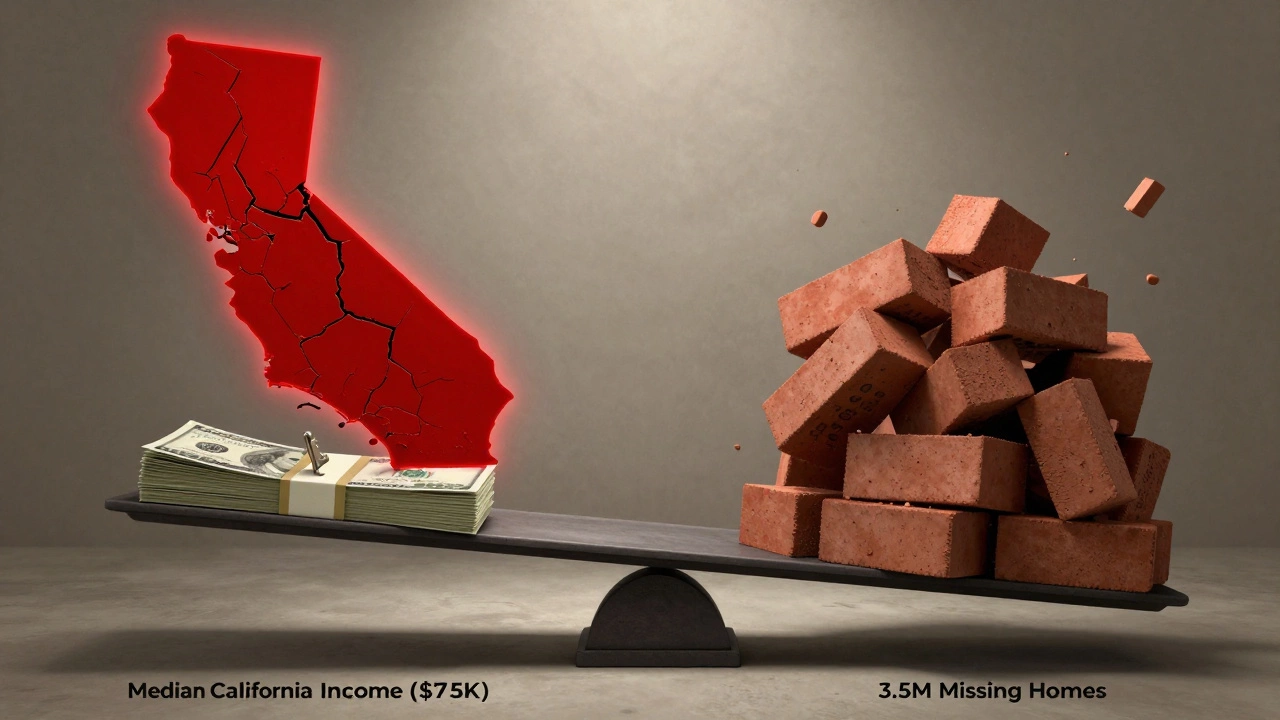

What does that mean for someone earning $75,000 a year? That’s above the state median income. Even then, they’d need to spend 58% of their take-home pay on rent alone. Financial experts say you should spend no more than 30%. California’s average renter spends 52%. That’s not budgeting-it’s survival mode.

Why California? It’s Not Just the Weather

People blame coastal cities, tech salaries, or NIMBYism. But the real problem is decades of underbuilding. Between 1990 and 2020, California added 1.5 million jobs but only 1.1 million housing units. That gap didn’t close-it widened. In 2025, the state still needed 3.5 million more homes just to meet demand. That’s more than the entire population of Colorado.

Local zoning laws make it nearly impossible to build anything but single-family homes in 80% of residential land. Even when cities try to allow duplexes or fourplexes, lawsuits and neighborhood opposition kill the projects. Meanwhile, construction costs in California are 40% higher than the national average. Labor, materials, and permitting fees add up fast. A 1,200-square-foot apartment in Sacramento costs $500,000 to build. In Texas, it’s $320,000.

Other States Are Catching Up-Fast

California isn’t alone. Hawaii sits at number two, with median home prices over $1.1 million. Renters there spend 57% of income on housing. But Hawaii’s population is tiny-just 1.4 million. The real threat is what’s happening in Washington, Oregon, and Colorado.

In Seattle, a one-bedroom rents for $2,900. In Portland, it’s $2,400. In Denver, it’s $2,300. These cities used to be affordable. Now, teachers, firefighters, and nurses are commuting 90 minutes just to find a place they can rent. In 2025, the Washington State Housing Finance Commission found that 60% of households earning under $60,000 were cost-burdened. That’s up from 38% in 2015.

Even states with lower taxes and no income tax aren’t safe anymore. Florida’s housing prices jumped 38% between 2020 and 2025. The average home in Orlando now costs $420,000. That’s up from $305,000 in 2020. Newcomers from California and New York drove prices up. But wages didn’t follow. A retail worker in Tampa now earns $18 an hour. Rent for a two-bedroom? $2,100.

The Numbers Don’t Lie-Here’s What Housing Costs Look Like

Let’s compare the real cost of renting a one-bedroom apartment in the top five most unaffordable states:

| State | Average Rent | % of Median Income Spent | Required Hourly Wage to Afford |

|---|---|---|---|

| California | $3,200 | 52% | $48.50 |

| Hawaii | $3,050 | 57% | $46.00 |

| Washington | $2,850 | 49% | $43.00 |

| Oregon | $2,500 | 45% | $38.00 |

| Colorado | $2,350 | 42% | $35.50 |

That required hourly wage is what you’d need to earn-after taxes-to afford rent without spending more than 30% of your income. In California, you’d need to make $48.50 an hour. That’s more than double the state’s median wage of $24.80. In most places, you’d need a second job just to make rent.

What About the Rest of the Country?

Most states still have places where you can live on a teacher’s salary. In Iowa, a one-bedroom rents for $950. In Mississippi, it’s $850. In West Virginia, you can find one for $700. But those places aren’t growing. They’re shrinking. Jobs are disappearing. Schools are closing. People aren’t moving there because they can’t afford to live in California-they’re moving there because they have no other choice.

The problem isn’t just high prices. It’s the collapse of the middle ground. Cities that used to be affordable stepping stones-like Austin, Nashville, and Atlanta-are now priced out. Austin’s median home price hit $580,000 in 2025. That’s up 75% since 2020. The city added 200,000 people in five years. It didn’t add enough housing. Now, even people who grew up there can’t buy a house.

Who Gets Left Behind?

It’s not just young people. It’s veterans. It’s single parents. It’s teachers. It’s nurses. In Los Angeles, 1 in 5 public school teachers live in their cars. In San Diego, 37% of emergency room nurses can’t afford to live in the city where they work. They sleep in RVs parked in church lots or drive 70 miles each way.

The U.S. Department of Housing and Urban Development says a household needs to earn 1.5 times the local rent to afford housing without help. In California, that means you need $5,500 a month in income to rent a $3,200 apartment. That’s not a middle-class income anymore. That’s a senior executive salary.

There’s No Easy Fix

Politicians talk about building more housing. But building more doesn’t mean building faster. Permitting still takes 18 to 36 months in most California cities. Environmental reviews delay projects for years. Community opposition kills them. Developers can’t get financing for projects that might take a decade to turn a profit.

Some cities are trying. Los Angeles passed a law allowing fourplexes on every residential lot. San Francisco is fast-tracking affordable housing projects. But these changes are slow. And they’re small. The state needs to build 1.2 million homes by 2030 just to catch up. At current rates, it’ll take 40 years.

Meanwhile, rents keep rising. Inflation hasn’t slowed. Interest rates are still high. Construction labor is scarce. The cost of lumber, steel, and concrete hasn’t dropped since 2023. The housing crisis isn’t getting better-it’s getting deeper.

What Can You Do?

If you’re stuck in a high-cost state, you have three real options:

- Move-to a state with lower costs and growing jobs. Places like Tennessee, Georgia, or North Carolina offer better pay-to-housing ratios. You’ll earn less, but you’ll live better.

- Live with roommates-in California, 62% of renters under 35 live with others. It’s not ideal, but it’s the only way to stay.

- Wait it out-if you’re young, have no debt, and can save aggressively, you might buy in 10 years. But that’s a gamble. Prices could keep rising. Or they could crash. No one knows.

There’s no magic solution. No tax credit, no subsidy, no government program will fix this overnight. The system is broken. And the people paying the price aren’t the rich. They’re the nurses, the teachers, the cashiers, the delivery drivers. They’re the ones who keep the country running-and now, they’re being pushed out of the places they built.

Which state has the highest rent in the U.S.?

California has the highest average rent in the U.S., with a one-bedroom apartment costing $3,200 per month on average as of 2025. San Francisco leads the state, with rents averaging $3,800. Hawaii is second, but California’s sheer size and population make its housing crisis the most widespread and impactful.

Why is housing so expensive in California?

California’s housing is expensive because it hasn’t built enough homes to match job growth for decades. Zoning laws restrict dense housing, construction costs are 40% higher than the national average, and permitting takes years. Meanwhile, demand keeps rising as people move there for jobs, schools, and climate. The result is a massive shortage-3.5 million homes short of what’s needed.

Can you live in California on $75,000 a year?

It’s extremely difficult. At $75,000 a year, your take-home pay is about $5,000 per month. After federal and state taxes, you’d need to spend over $3,000 on rent for a one-bedroom in most cities. That’s 60% of your income. You’d have little left for food, transportation, healthcare, or savings. Many people in this income bracket live with multiple roommates or commute over an hour each way.

What state is the most affordable to live in?

Mississippi is the most affordable state, with a one-bedroom apartment averaging $850 per month. Other low-cost states include West Virginia, Arkansas, and Alabama. But affordability often comes with fewer job opportunities, lower wages, and limited public services. Many people who move there do so because they can’t afford to stay elsewhere.

Is it better to rent or buy in an unaffordable state?

In most unaffordable states, renting is the only realistic option for most people. Buying requires a 20% down payment-which in California means $180,000 for a $900,000 home. Few can save that much. Even if they can, monthly mortgage payments are often higher than rent. Plus, property taxes and insurance add hundreds more. Renting gives flexibility, even if it feels like throwing money away.