Commercial Property Made Simple: What You Need to Know Right Now

Thinking about a commercial space? Whether it’s a shop, office, or warehouse, the basics stay the same: you want a good deal, the right cash flow, and a stress‑free purchase. In this guide we’ll break down the most common questions – from cap rates and loan terms to the best property types for 2025. No jargon, just the facts you can use today.

How to Tell If a Property Is Worth the Money

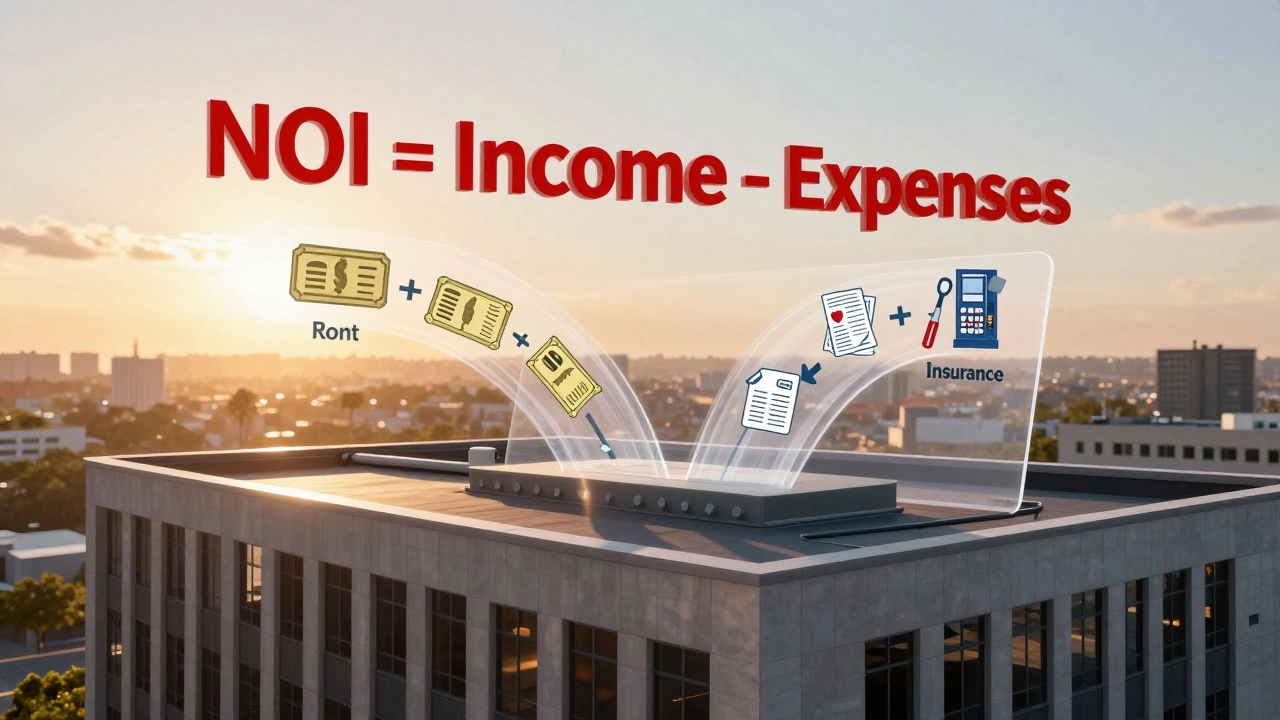

The first thing most investors look at is the cap rate. In plain English, it’s the net operating income (NOI) divided by the asking price. A 7.5% cap rate, for example, means you’d earn $75,000 on a $1 million purchase before financing costs. If the numbers look higher than the market average, the deal is likely solid – but always double‑check expenses and vacancy rates.

Another quick method is the income approach. Take the annual rent you expect, subtract operating costs, and apply a multiplier that reflects local market risk. This gives you a ballpark value without needing a full appraisal. Many of our readers find it helpful to run both the cap rate and income approach side by side to spot any red flags.

Financing Tips That Save You Money

Getting a loan for commercial property is different than a home mortgage. Banks still look at credit, cash flow, and the property’s location, but they also consider the loan‑to‑value (LTV) ratio. In 2025, the lowest‑interest‑rate banks are offering LTVs around 75%, meaning you need a 25% down payment. Some lenders will go lower if you have strong cash flow or a solid business plan.

If you’re short on cash, explore the lowest‑down‑payment options. Certain lenders accept as little as 10% down for qualified buyers, especially for properties with stable tenants. Just remember, a smaller down payment usually means higher monthly payments and stricter covenants.

Don’t forget about equity pull‑outs. Once your property has appreciated, you can refinance and pull cash to fund another deal or upgrade the current space. It’s a common way to accelerate growth without selling.

Lastly, keep an eye on the average loan term. Most commercial loans run between 5 and 20 years. Shorter terms lower interest costs but increase monthly payments. Pick a term that matches your cash flow projections.

Beyond finance, knowing which property types perform best can boost your returns. Office spaces in secondary cities, multi‑family buildings, and industrial warehouses have shown strong profit margins in recent years. Retail can still work, but look for locations with high foot traffic and low vacancy.

And don’t overlook the future. Technology and sustainability are reshaping the market – think smart building systems, energy‑efficient designs, and flexible workspaces. Properties that adapt to these trends tend to hold value longer and attract premium tenants.

Ready to take the next step? Start by running the cap rate and income calculations on any property you’re eyeing. Then line up a few lenders, compare down‑payment requirements, and think about how you might use equity later on. With clear numbers and a solid financing plan, you’ll be in a good position to make a smart commercial property move.

How to Market Commercial Real Estate Effectively in 2026

Learn how to effectively market commercial real estate in 2026 with proven strategies for targeting tenants, using visuals, choosing platforms, and offering flexible terms. Stop guessing-start closing deals.

What Is a CPM in Real Estate? Understanding Cost Per Thousand for Commercial Properties

CPM in real estate means Cost Per Thousand - how much it costs to show your ad to 1,000 people near a commercial property. Learn how it’s calculated, why it matters for leasing, and how to use it to make smarter decisions.

Where Is the Most Money in Commercial Real Estate?

Industrial warehouses, multi-family buildings, and neighborhood retail are generating the highest returns in commercial real estate in 2025. Learn where the real money is-and where to avoid investing.

What Is a Good CPM Price for Commercial Property Advertising?

A good CPM price for commercial property ads in 2025 isn't about being cheap-it's about reaching the right people. Learn real rates in Australia and how to turn impressions into leases.

What Does NOI Mean in Commercial Property Sales?

NOI, or Net Operating Income, is the key metric for evaluating commercial property value. It shows true profitability after operating expenses but before taxes and loans. Learn how to calculate it and why it matters more than rent.

What Is the Big 4 in Real Estate? Top Firms That Dominate Commercial Property Sales

The Big 4 in real estate-CBRE, JLL, Cushman & Wakefield, and Savills-dominate global commercial property sales. Learn who they are, how they work in Australia, and when to use them-or avoid them.

Best Places to Get Commercial Real Estate News Today

Find the most reliable sources for commercial real estate news, from CoStar and CRE Insider to local planning portals and trusted newsletters. Get real data, not fluff, to make smarter property decisions.

Best Websites to Find Commercial Property for Sale in 2025

Find the best websites to buy commercial property in Australia in 2025. Learn where to find verified listings, off-market deals, and how to avoid common pitfalls when investing in retail, industrial, or office spaces.

Can Property Ownership Turn You Into a Millionaire?

Explore how property ownership can build wealth, the key drivers like appreciation and leverage, and realistic steps to become a millionaire through real estate.

What Type of Rental Property Makes the Most Money?

Discover which rental property type delivers the highest return, how to calculate ROI, and what factors affect cash flow. A practical guide for investors in 2025.

What’s a Good Cap Rate for Commercial Property?

Learn what makes a cap rate good for commercial property, see typical benchmarks, and get a step‑by‑step guide to calculate and interpret cap rates in 2025.

Who Invests in Commercial Real Estate? Types, Strategies & Trends

Explore the key players behind commercial real estate deals-from REITs and pension funds to high‑net‑worth individuals-and learn their strategies, typical capital sizes, and current market trends.