Rent-to-Own Contract Duration Calculator

Find Your Ideal Contract Duration

Your Recommended Contract Duration

When you hear "rent-to-own" you probably wonder how long the commitment actually lasts. Most rent-to-own contracts range between two and five years, but the exact period depends on a handful of variables that we’ll break down below.

What Does a Rent-to-Own Contract Look Like?

Rent-to-Own Contract is a legal agreement that combines a standard lease with an option to purchase the property at a predetermined price after a set period. It typically splits into two phases: a rental phase and an option phase. The rental phase lets you live in the home while building equity, and the option phase gives you the right-though not the obligation-to buy.

Option Period refers to the timeframe during which the tenant can exercise the purchase right usually measured in months or years, and it often runs concurrently with the lease term. If the option isn’t exercised, the agreement simply ends as a regular lease.

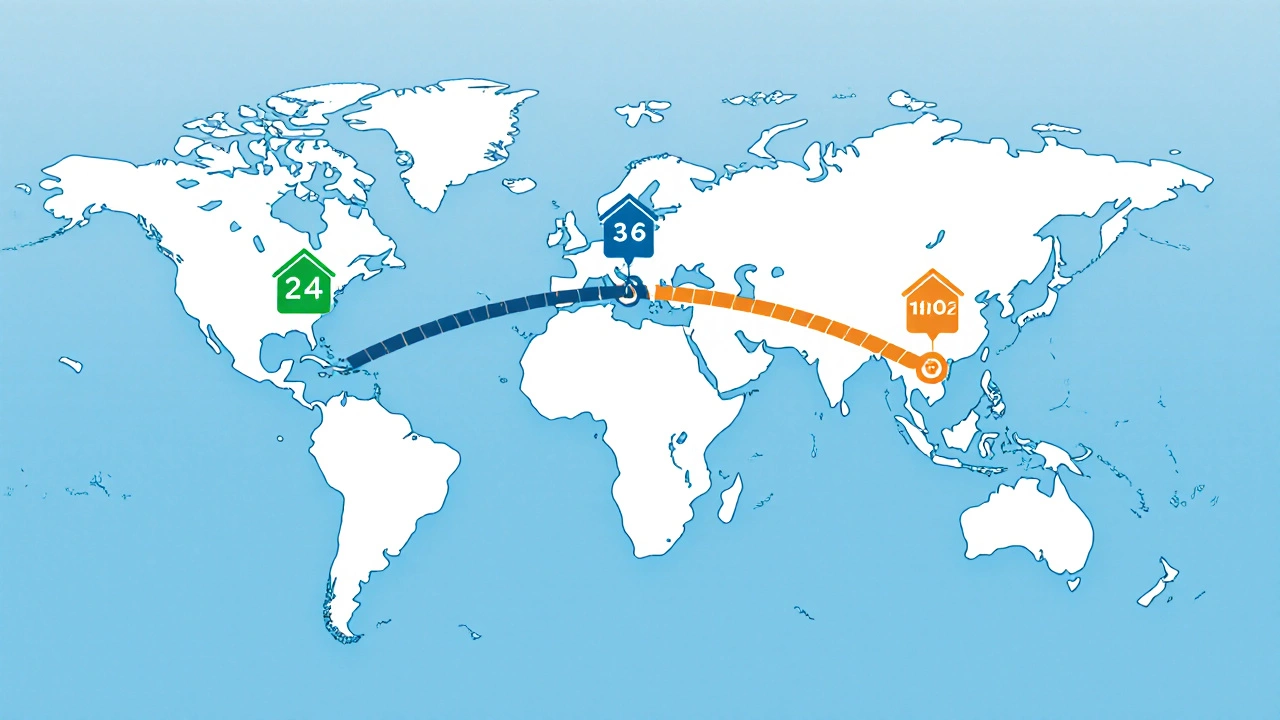

Typical Contract Lengths by Region

In Australia, most rent-to-own deals span 24 to 48 months. The Australian Securities and Investments Commission (ASIC) notes that a four‑year term balances affordability with a realistic chance of saving enough for a deposit.

In the United States, contracts commonly run 36 to 60 months, with some states allowing up to 84 months. A 2023 study by the National Association of Realtors found that 68% of rent-to-own agreements fall in the three‑to‑five‑year window.

The United Kingdom usually limits contracts to 12‑36 months, reflecting tighter mortgage qualification periods. These ranges aren’t set in stone; they shift based on market conditions, property type, and the parties’ negotiation power.

Key Factors That Shape the Duration

- Lease Term the length of the rental portion, often aligned with the option period. Longer lease terms can lower monthly rent but extend the overall commitment.

- Purchase Price the price locked in at the start of the contract; a higher price may encourage a shorter term to reduce market risk.

- Security Deposit usually a percentage of the purchase price that can be applied toward the down‑payment if the option is exercised. Larger deposits often lead to shorter contracts because the buyer has more equity early on.

- Maintenance Responsibility who handles repairs; when the tenant takes on more responsibilities, landlords may agree to a shorter term.

- Credit Check the tenant’s credit score influences the risk profile and can shorten or lengthen the agreement.

- Default Clause terms outlining penalties for missed payments, which affect how flexible the contract length can be.

How the Agreement Is Structured

- Sign the Rent-to-Own Contract and pay an upfront option fee, typically 1-5% of the purchase price.

- Pay monthly rent, a portion of which may be credited toward the eventual down‑payment.

- During the Option Period, monitor market conditions and assess your financial readiness.

- At the end of the period, decide whether to exercise the purchase option.

- If you buy, the Security Deposit and any rent credits are applied to the down‑payment.

- If you walk away, you forfeit the option fee and any rent credits.

Short vs. Long Terms: Pros and Cons

| Aspect | Short Term (12‑24mo) | Long Term (36‑60mo) |

|---|---|---|

| Monthly Payment | Higher, but faster equity buildup | Lower, spreads cost over time |

| Equity Accumulation | Rapid, thanks to larger rent credits | Slower, credits accumulate gradually |

| Market Risk | Less exposure to price swings | More exposure; price may rise above locked purchase price |

| Flexibility | Less time to adjust if finances change | More breathing room to improve credit or save |

Checklist Before Signing a Rent-to-Own Deal

- Confirm the exact Lease Term and Option Period.

- Verify how much of each rent payment is credited toward the purchase.

- Ask who handles Maintenance Responsibility and what costs you might incur.

- Review the Default Clause for penalties and repossession triggers.

- Check if the Purchase Price is fixed or subject to market adjustments.

- Ensure the Security Deposit is refundable or applicable to the down‑payment.

- Ask whether the seller will cover any Closing Costs or if they are your responsibility.

- Get a copy of the full agreement reviewed by a property lawyer.

Common Misconceptions

Many think a rent-to-own contract is a shortcut to homeownership without any credit check. In reality, landlords still assess credit risk, and a poor score can lead to higher fees or shorter terms.

Another myth is that all rent credits automatically become equity. Some agreements cap the credit at a certain percentage, so you need to read the fine print.

Frequently Asked Questions

Frequently Asked Questions

What is the average length of a rent-to-own contract in Australia?

Most contracts run between 24 and 48 months, balancing the need for affordable monthly payments with enough time to save for a down‑payment.

Can I shorten the contract once it’s signed?

Only if the landlord agrees in writing. Early termination often triggers a penalty outlined in the Default Clause.

Do rent-to-own payments count toward my mortgage?

A portion of each rent payment is usually credited toward the purchase price, but it doesn’t build traditional credit history. You’ll still need a mortgage approval if you exercise the option.

What happens to my option fee if I don’t buy?

The fee is typically non‑refundable. It compensates the seller for taking the property off the market during the option period.

Is a rent-to-own contract a good fit for first‑time buyers?

It can be, especially if you need time to improve credit or save a larger deposit. However, compare the total cost against a traditional mortgage to ensure you’re not overpaying.

Next Steps If You’re Ready

Start by listing properties that advertise a rent-to-own option. Request the full contract and run it through the checklist above. If anything feels unclear, reach out to a real‑estate lawyer familiar with lease‑to‑own arrangements. Taking these steps will help you lock in a contract length that matches your timeline and financial goals.