Legal & Tax Resources for Homeowners and Renters

Buying or renting a home can feel overwhelming, especially when legal rules and tax codes get in the way. The good news? You don’t need a law degree to understand the basics. Below you’ll find straight‑forward advice that helps you avoid costly mistakes and stay confident in every deal.

Whether you’re a first‑time buyer in Shriram Chirping Woods, a tenant dealing with a landlord, or an investor figuring out tax residency, these guides give you clear steps you can follow today. No jargon, no filler – just the facts that matter.

Landlord‑Tenant Rules You Should Know

Every state has its own set of landlord‑tenant laws, and they change from year to year. In Virginia, for example, landlords cannot enter your rental without proper notice, and illegal evictions are prohibited. Maryland’s 2024 updates added tighter limits on security deposits and new eviction timelines. Knowing these details protects your rights and helps you negotiate better lease terms.

If you’re a landlord, remember that you must follow the same rules you expect tenants to obey. Drafting a simple payment agreement can save you headaches later. Include the amount, due date, and what happens if a payment is missed. A clear contract keeps both sides on the same page and makes enforcement easier.

Tenants, don’t forget to check your local residency status if you’re moving from another country. Australian residents, for instance, need to verify their legal residency date to claim tax benefits. A quick check on official immigration records can confirm when you became a resident, saving you from future disputes.

Tax Tips for Residents and Investors

Tax residency is more than a label – it determines which income you must report and which deductions you can claim. In Australia, the “residency test” looks at your intention, behavior, and ties to the country. If you’re unsure, compare the resident vs. non‑resident guidelines and use the simple checklist provided in our guides.

Property taxes vary wildly across the U.S. Some counties charge double the national average, while others offer senior relief programs. Virginia, for example, provides tax breaks for seniors who meet income thresholds. Knowing where you stand can lower your bill by thousands of dollars.

Paying personal property tax in Virginia is easier than it sounds. Most counties accept online payments, mail‑in checks, and in‑person drops. Mark the due dates on your calendar, set up reminders, and double‑check the payment portal to avoid late fees.

Investors often wonder who pays the most in property taxes. High‑tax areas usually fund extensive local services, but they can also erode your return on investment. Use our “highest property tax” guide to compare rates and decide if a higher‑tax market still makes sense for your portfolio.

Finally, if you need a quick, no‑stress payment contract, our simple payment agreement template walks you through each clause. It covers the basics – amount, schedule, penalties – without legalese that confuses you.

Keep these resources handy when you start a new real‑estate transaction. The right knowledge saves time, money, and stress, letting you enjoy the peaceful life Shriram Chirping Woods promises.

Are Property Taxes Paid in Advance or Arrears in Virginia?

Virginia property taxes are typically paid in arrears, with bills due in June and December covering the previous six months. But rules vary by county - knowing your local schedule prevents penalties and surprises.

How Much Is Virginia Property Tax? Rates, Calculations, and What You Pay in 2026

Virginia property tax rates vary by county, with averages around 0.84%. Learn how your home's assessed value, local rates, and exemptions affect your bill-and how to save money legally.

What Is the 6-Year Rule for Non-Residents in Australia?

The 6-year rule lets non-residents avoid capital gains tax on a former main residence in Australia if they rented it out for up to six years after moving overseas. It only applies if you lived in the property before becoming a non-resident.

Baltimore City Rental License: Do You Need One to Rent Your House?

Learn if a Baltimore City Rental License is required for renting your house, the steps to obtain it, costs, and common pitfalls. Clear guide for short‑term and long‑term rentals.

Is a Handwritten Rental Agreement Legal? Essential Guide for Tenants and Landlords

A clear guide explaining when a handwritten rental agreement is legal in Australia, covering essential contract elements, state laws, risks, and a practical checklist.

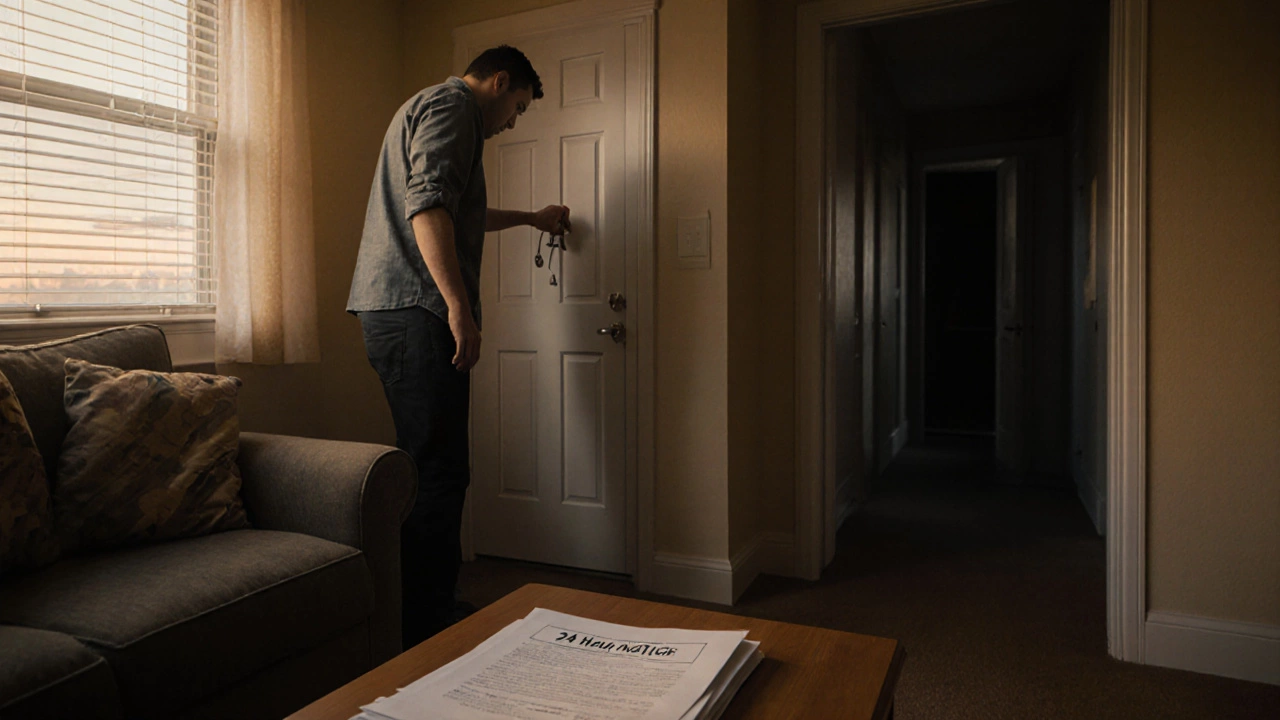

Baltimore City Eviction Timeline: How Long Does It Really Take?

Learn the typical 45‑70 day eviction timeline in Baltimore City, from notice periods to court hearings and writ of possession, with tips to avoid common delays.

Can a Landlord Enter Without Permission in Maryland? Your Legal Guide

Discover Maryland's rules on landlord entry: notice requirements, emergency exceptions, tenant rights, and steps to handle illegal entries-all in clear, practical language.

Zillow Lawsuit 2025: What Is Zillow Being Sued For Right Now?

Straight answer on why Zillow is being sued: the key cases, what they allege, where they stand in 2025, and what it means for buyers, sellers, and agents.

Check Your Legal Residency Date in Australia: Easy Steps for Proof

Find out exactly when you became a legal resident in Australia. A practical, easy-to-follow guide packed with tips, official sources, and simple advice for getting your proof.

VA Landlord Tenant Laws: What Landlords Legally Cannot Do in Virginia

Explore what actions Virginia landlords are forbidden to take, from illegal evictions to entering your apartment without notice. Stay informed and protect your rights.

Residency vs. Nonresidency: A Straightforward Guide for Tax and Legal Status

Confused about tax residency in Australia? Get clear, practical info on how to tell if you're a resident or nonresident. Find out what rules apply, why it matters, and avoid costly mistakes.

Maryland Landlord-Tenant Law 2024: Key Updates, Rights, and What to Expect

Explore a simple breakdown of Maryland’s 2024 landlord-tenant law. Learn the biggest changes in tenant protection, eviction rules, security deposits, and your rental rights.